Interest Revenue Debit Or Credit

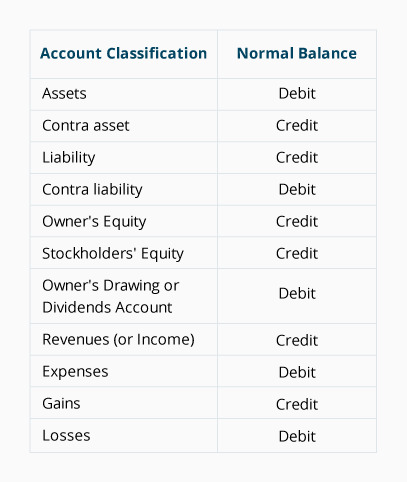

Normal Balances

When looking at an business relationship in the general ledger, the post-obit is the debit or credit balance y'all would normally find in the account:

Revenues and Gains Are Usually Credited

Revenues and gains are recorded in accounts such every bit Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. These accounts normally take credit balances that are increased with a credit entry. In a T-account, their balances will exist on the right side.

The exceptions to this rule are the accounts Sales Returns, Sales Allowances, and Sales Discounts—these accounts accept debit balances because they are reductions to sales. Accounts with balances that are the reverse of the normal rest are called contra accounts; hence contra revenue accounts will accept debit balances.

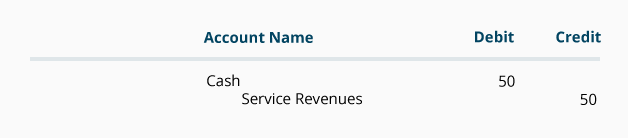

Let's illustrate revenue accounts past assuming your company performed a service and was immediately paid the full amount of $fifty for the service. The debits and credits are presented in the following full general journal format:

Whenever cash is received, the asset account Greenbacks is debited and another account will need to be credited. Since the service was performed at the aforementioned time every bit the cash was received, the revenue business relationship Service Revenues is credited, thus increasing its account residual.

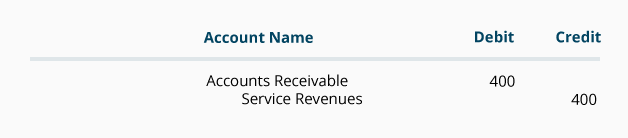

Permit's illustrate how revenues are recorded when a company performs a service on credit (i.e., the company allows the customer to pay for the service at a later on appointment, such as thirty days from the date of the invoice). At the time the service is performed the revenues are considered to accept been earned and they are recorded in the revenue account Service Revenues with a credit. The other business relationship involved, however, cannot exist the asset Cash since cash was not received. The account to be debited is the asset account Accounts Receivable. Assuming the amount of the service performed is $400, the entry in general journal form is:

Accounts Receivable is an asset account and is increased with a debit; Service Revenues is increased with a credit.

Expenses and Losses are Usually Debited

Expenses ordinarily have debit balances that are increased with a debit entry. Since expenses are ordinarily increasing, recall "debit" when expenses are incurred. (Nosotros credit expenses merely to reduce them, conform them, or to close the expense accounts.) Examples of expense accounts include Salaries Expense, Wages Expense, Rent Expense, Supplies Expense, and Interest Expense. In a T-account, their balances will be on the left side.

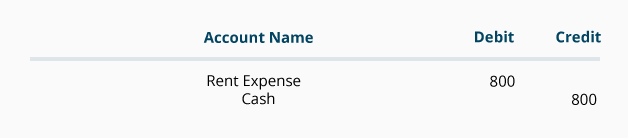

To illustrate an expense permit's presume that on June 1 your company paid $800 to the landlord for the June rent. The debits and credits are shown in the following journal entry:

Since cash was paid out, the asset account Cash is credited and another business relationship needs to be debited. Because the rent payment will be used up in the current period (the month of June) it is considered to be an expense, and Rent Expense is debited. If the payment was made on June ane for a time to come calendar month (for example, July) the debit would go to the nugget business relationship Prepaid Rent.

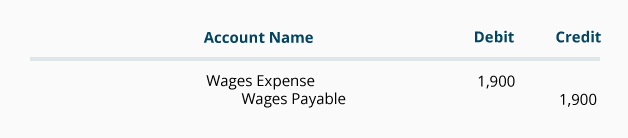

As a second example of an expense, allow's assume that your hourly paid employees work the last calendar week in the year but will not be paid until the first calendar week of the side by side year. At the end of the year, the visitor makes an entry to tape the amount the employees earned but have not been paid. Assuming the employees earned $one,900 during the concluding week of the year, the entry in general journal form is:

As noted earlier, expenses are almost e'er debited, so we debit Wages Expense, increasing its account balance. Since your visitor did not yet pay its employees, the Cash account is not credited, instead, the credit is recorded in the liability account Wages Payable. A credit to a liability account increases its credit balance.

To help you go more than comfy with debits and credits in accounting and bookkeeping, memorize the following tip:

Here'southward a Tip

To increase an expense account, debit the business relationship.

Permanent and Temporary Accounts

Nugget, liability, and nigh owner/stockholder equity accounts are referred to as permanent accounts (or existent accounts). Permanent accounts are non closed at the end of the accounting year; their balances are automatically carried forward to the next accounting year.

Temporary accounts (or nominal accounts) include all of the revenue accounts, expense accounts, the owner's drawing account, and the income summary account. Generally speaking, the balances in temporary accounts increase throughout the accounting year. At the end of the accounting year the balances will be transferred to the owner'south uppercase account or to a corporation's retained earnings account.

Because the balances in the temporary accounts are transferred out of their corresponding accounts at the stop of the accounting year, each temporary business relationship will take a zero residue when the side by side accounting year begins. This ways that the new bookkeeping year starts with no revenue amounts, no expense amounts, and no amount in the drawing account.

By having many acquirement accounts and a huge number of expense accounts, a company will be able to study detailed information on revenues and expenses throughout the year.

Interest Revenue Debit Or Credit,

Source: https://www.accountingcoach.com/debits-and-credits/explanation/3

Posted by: handyowly1985.blogspot.com

0 Response to "Interest Revenue Debit Or Credit"

Post a Comment